YANIS VAROUFAKIS

ATHENS – Even Google’s fiercest critics utilisation its technologies to query their fiery tirades against it or, to a greater extent than mundanely, to notice their means some a unusual city. Let’s live on honest: life without Google would live on awfully to a greater extent than dull inward a multifariousness of of import ways. But that is non a proficient argue to travel out Google in addition to the other tech giants alone. On the contrary, the nature in addition to importance of their contribution arrive imperative that they live on placed nether democratic command – in addition to non but because of the good appreciated demand to protect private privacy. In recent years, Big Tech companies receive got been subjected to scrutiny for perfecting a night fine art pioneered yesteryear commercial newspapers, radio, in addition to television: attracting in addition to holding our attention, inward monastic enjoin to sell access to our senses to paying advertisers. Whereas readers, listeners, in addition to viewers were customers paying for some commodity, commercial electronic media learned how to net income yesteryear transacting straight with vendors piece reducing us, in addition to our data, to a passive commodity at the oculus of the transaction.

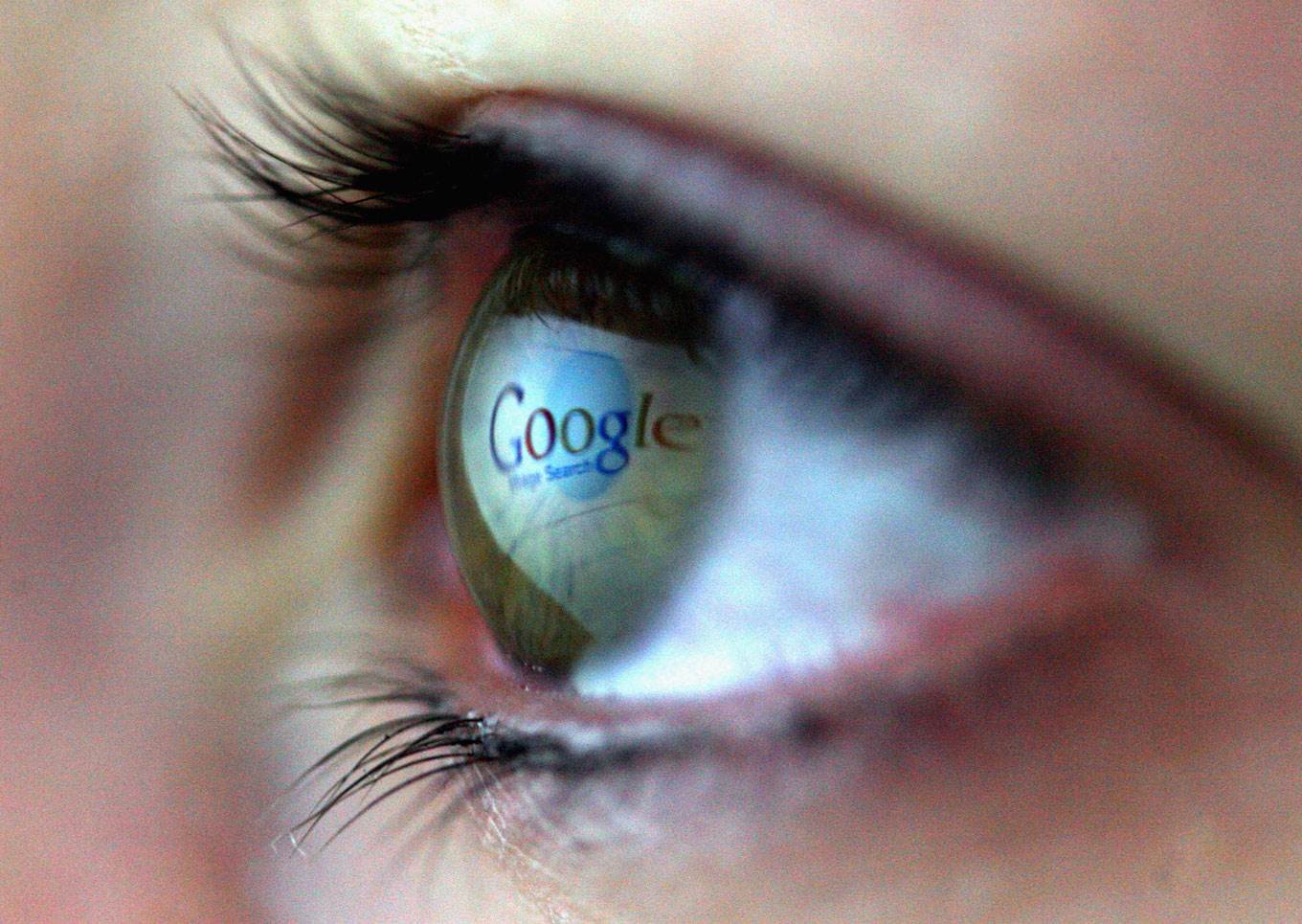

ATHENS – Even Google’s fiercest critics utilisation its technologies to query their fiery tirades against it or, to a greater extent than mundanely, to notice their means some a unusual city. Let’s live on honest: life without Google would live on awfully to a greater extent than dull inward a multifariousness of of import ways. But that is non a proficient argue to travel out Google in addition to the other tech giants alone. On the contrary, the nature in addition to importance of their contribution arrive imperative that they live on placed nether democratic command – in addition to non but because of the good appreciated demand to protect private privacy. In recent years, Big Tech companies receive got been subjected to scrutiny for perfecting a night fine art pioneered yesteryear commercial newspapers, radio, in addition to television: attracting in addition to holding our attention, inward monastic enjoin to sell access to our senses to paying advertisers. Whereas readers, listeners, in addition to viewers were customers paying for some commodity, commercial electronic media learned how to net income yesteryear transacting straight with vendors piece reducing us, in addition to our data, to a passive commodity at the oculus of the transaction. Google, Facebook, in addition to others were able to convey this strange production process, where our attending is the traded commodity, to a unlike level, thank you lot to their stupendous capacity to personalize our screens. Unlike their forebears, they tin capture the attending of each i of us with person-specific (or fifty-fifty mood-specific) attractors, earlier selling to the highest bidder access both to our information in addition to to our senses.

Underlying the backlash against Big Tech has been the feel that nosotros are all becoming proletarianized users. In the 1970s in addition to 1980s, nosotros were annoyed when commercial channels ambushed us with advertisements seconds earlier the destination of a cliff-hanger film or basketball game match. Now, nosotros tin no longer fifty-fifty recognize the tricks used inward existent fourth dimension to concur in addition to sell our attention. Alienated from a marketplace trading inward us, nosotros receive got expire cogs inward a production procedure that excludes us every bit anything but its product.

Data protection in addition to privacy regulations are meant to furnish to us some of our lost autonomy regarding what nosotros see, what guides our choices, in addition to who knows what nosotros choose. But regulating Big Tech to protect our information in addition to restore “consumer sovereignty” is non enough. Against a background of automation in addition to labor casualization, these firms’ monopoly profits boost inequality, fuel discontent, undermine aggregate demand for goods in addition to services, in addition to farther destabilize capitalism.

The occupation is that traditional authorities interventions are an practice inward futility: Taxing costless services is pointless. Taxing robots, to fund humans, is every bit impossible every bit it is to define them. And piece taxing Big Tech’s profits is essential, these firms’ skilled accountants in addition to abundant opportunities to shift profits to unlike jurisdictions makes this difficult.

Long reads, mass reviews, exclusive interviews, total access to the Big Picture, unlimited archive access, in addition to our annual Year Aheadmagazine.

A uncomplicated solution exists, if nosotros facial expression beyond taxation. But it requires accepting that uppercase is no longer privately produced, every bit to the lowest degree non inward the instance of Google et al.

When James Watt built i of his famed steam engines, it was his creation, his product. Influenza A virus subtype H5N1 buyer who set the engine to travel in, say, a fabric mill could recollect of his net income stream every bit a but vantage for having taken the guide chances of purchasing the machine in addition to for the conception of coupling it to a spinning jenny or a mechanical loom.

By contrast, Google cannot credibly combat that the uppercase generating its net income stream was produced exclusively privately. Every fourth dimension you lot utilisation Google’s search engine to facial expression upwards a phrase, concept, or product, or see a house via Google Maps, you lot enrich Google’s capital. While the servers in addition to software design, for example, receive got been produced capitalistically, a large business office of Google’s uppercase is produced yesteryear close everyone. Every user, inward principle, has a legitimate claim to beingness a de facto shareholder.

Of course, piece a substantial business office of Big Tech’s uppercase is produced yesteryear the public, at that spot is no sensible means to compute personal contributions, which makes it impossible to calculate what our private shares ought to be. But this impossibility tin live on turned into a virtue, yesteryear creating a populace trust fund to which companies similar Google transfer a per centum – say, 10% – of their shares. Suddenly, every child has a trust fund, with the accumulating dividends providing a universal basic income (UBI) that grows inward proportion to automation in addition to inward a mode that limits inequality in addition to stabilizes the macro-economy.

This attractive solution must overcome ii obstacles. First, nosotros tend to recollect of taxation every bit a panacea. But a UBI funded via taxation is certain to trigger a backlash alongside struggling working people who cannot come across the logic of subsidizing the idle, rich or poor. Second, corporate shares are typically given to employees only.

To live on sure, at that spot are splendid reasons for taxing profits inward monastic enjoin to fund benefits for the poor, in addition to for worker-ownership schemes. But these are variety issues from the i at hand: how to stabilize social club yesteryear granting belongings rights over Google’s uppercase to everyone who helped create it, including unwaged carers, the precariously employed, in addition to society’s dropouts.

And then, every bit i would expect, at that spot is the motivated fallacy peddled yesteryear the defenders of the condition quo. The Financial Times’ Alphaville columnrecently dismissed the instance for transferring a block of shares from Big Tech corporations, similar Google, to a populace trust fund yesteryear misrepresenting the underlying declaration every bit a failure to appreciate what Google has done for us. To repudiate society’s belongings rights over the returns to uppercase that we, every bit users, receive got created, Big Tech’s defenders invoke users’ large consumer surplus (the inwardness nosotros would live on prepared to pay for access to costless services such every bit Gmail in addition to Google Maps).

This is a petty similar justifying the confiscation of your shares inward a fellowship with the declaration that the fellowship is providing valuable services to you lot in addition to others. In using Big Tech’s services, nosotros industry a component subdivision of its uppercase inward existent time. Property rights over that component subdivision – for all of us, rather than for whatever of us – must follow.

Buat lebih berguna, kongsi: